Charlotte County: The Land of Opportunity (Zones)

Opportunity Zones Offer a New Way to Reduce Taxes on Capital Gains.

There’s a new tool in Charlotte County’s economic development toolbox: Opportunity Zones. Charlotte County has three geographic areas certified by the U.S. Treasury as economic Opportunity Zones. These zones were created by the Federal Tax Cut and Jobs Act of 2017, and are designed to stimulate private, long‐term investment in economically distressed areas. The benefit for business? Generous tax incentives, including the waiver of federal capital gains taxes. Opportunity Zone investment is available for ten years beginning in 2017.

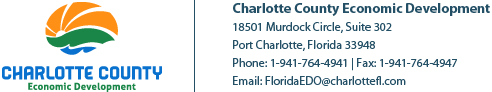

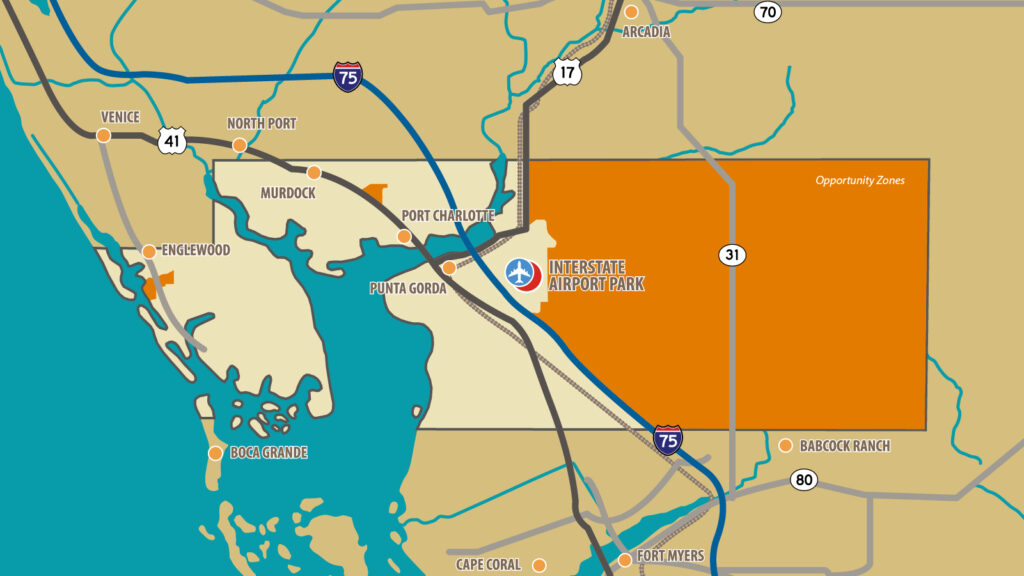

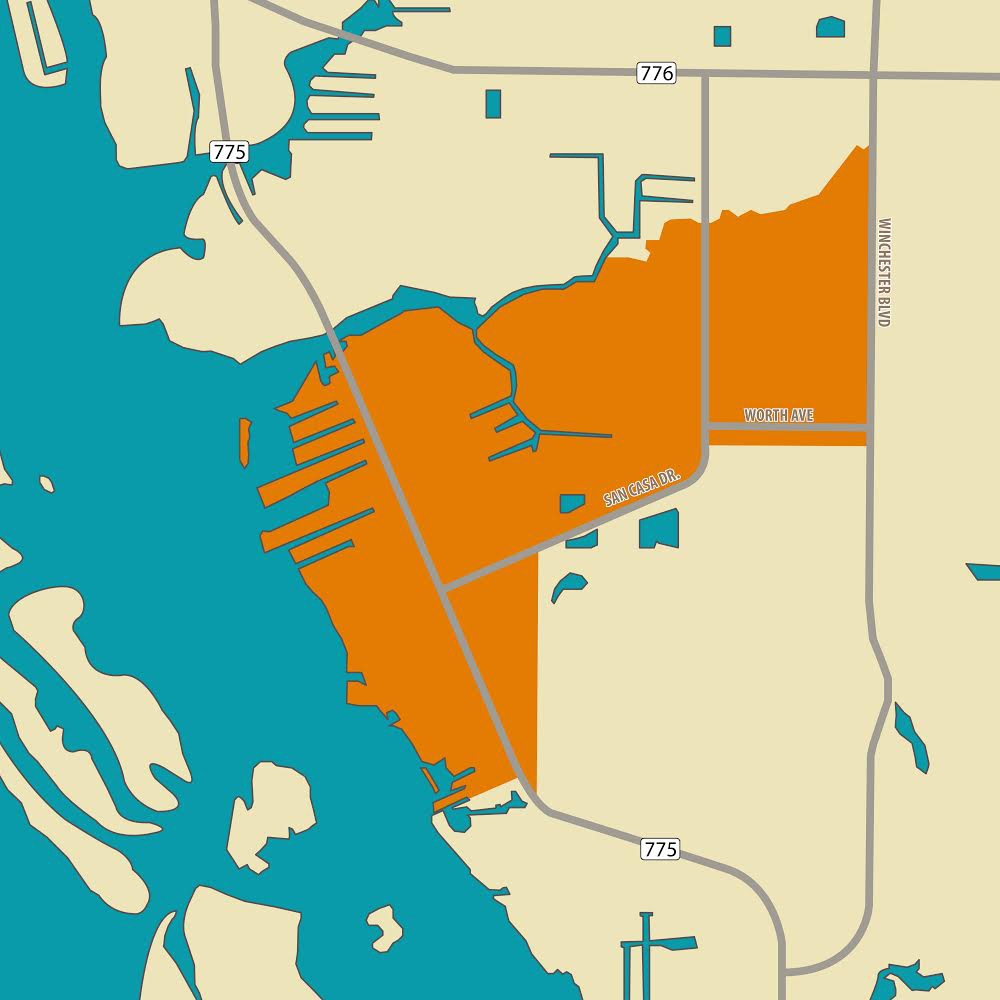

The three designated Opportunity Zones in Charlotte County (see map) are a large area east of the city of Punta Gorda; a smaller tract north of Charlotte Harbor; and a comparable tract on the western edge of the county on the Gulf of Mexico. Charlotte County’s three Opportunity Zones are census tracts that were submitted for approval to the U.S. Treasury Department by Governor Rick Scott’s office (note: census tracts correspond roughly to neighborhoods, with an average population of 4,000 people).

Investment Overview

Opportunity Funds allow investors to defer and reduce the amount of tax they owe on capital gains. The Tax Cuts and Jobs Act of 2017 contains the following requirements:

- Opportunity Funds must hold 90% of assets in designated Opportunity Zone properties or businesses.

- If used for property purchases, the property must also be improved after the purchase.

- Investments in a business require the purchase of stock or a partnership. Loans are not valid.

- Investments can be combined with other tax-advantaged vehicles such as the Low Income Housing Tax Credit.

- Investments can be made in any Opportunity Zone in the U.S. and/or in multiple zones.

Tax Benefits of Opportunity Zone Funds

- Temporary Deferral

- Capital gains from the sale of any asset (if reinvested in 180 days) are deferred until the sale of the new investment, or December 31, 2026, whichever is earlier.

- Step-Up in Basis

- Any investment reinvested and held for 5 years gets a tax basis increase of 10%, and any investment held for 7 years gets a tax basis increase of 15%.

- Permanent Exclusion

- Investments held for 10 years will pay no capital gains tax on the post-acquisition gains. This permanent exclusion applies only to the gains accrued in the OZ Fund.

To learn more about the advantages of investing in Opportunity Zones, and to explore qualified sites and properties, talk to the Charlotte County Economic Development Office today.